Ad Frauds Barometer - Sham forms, i.e. frauds in CPL

source: own elaboration

As previously announced, in today’s Ad Frauds Barometer we will take a look at the subject of fraud in CPL campaigns - those in which advertisers settle with publishers for a contact form sent with a potential customer’s data. Looking at the Polish market, one can get the impression that this type of campaigns have their glory years behind them - why is it so? We will try to highlight the problem and describe the mechanisms that in our opinion, at least in part, have led to this state of affairs.

The first decade of the 21st century was a period of intense customer acquisition in CPL campaigns. Financial institutions were the leaders; the price of a contact to a customer interested in a cash loan often exceeded PLN 50, and for mortgages PLN 150 or more was paid. Such high rates allowed many customer acquisition intermediary companies to develop, their contact databases grew to gigantic sizes. However, as time went by, cost pressures from advertisers emerged and many institutions began to analyse the effectiveness of their campaigns in more detail while lowering the rates per lead. At the same time (who is able to say which came first?), some publishers saw an opportunity for additional, easy income and started to „inject” customer data from their own databases into various contact forms (often without the customers’ knowledge) or multiply the acquired contacts to many institutions at the same time. There was and is a story to this! The idea was to familiarise the customer with a number of offers, while on the other side operational efficiency was to be decisive - i.e. the speed with which the lead was taken up by the call centre according to the „first come, first served” principle.

We didn’t have to wait long for the effects, falling sales conversions (multiplication!) resulted in a systematic reduction of the applicable CPL rates, while on the other hand, lower remuneration per lead provoked publishers to greater multiplication of acquired contacts. Why? The cost of acquiring customers was not decreasing, so in order to maintain adequate profitability of sales, the lower unit price per lead was compensated by a higher multiplication factor (instead of sending a customer to 2-3 institutions, they were sent to 5-6).

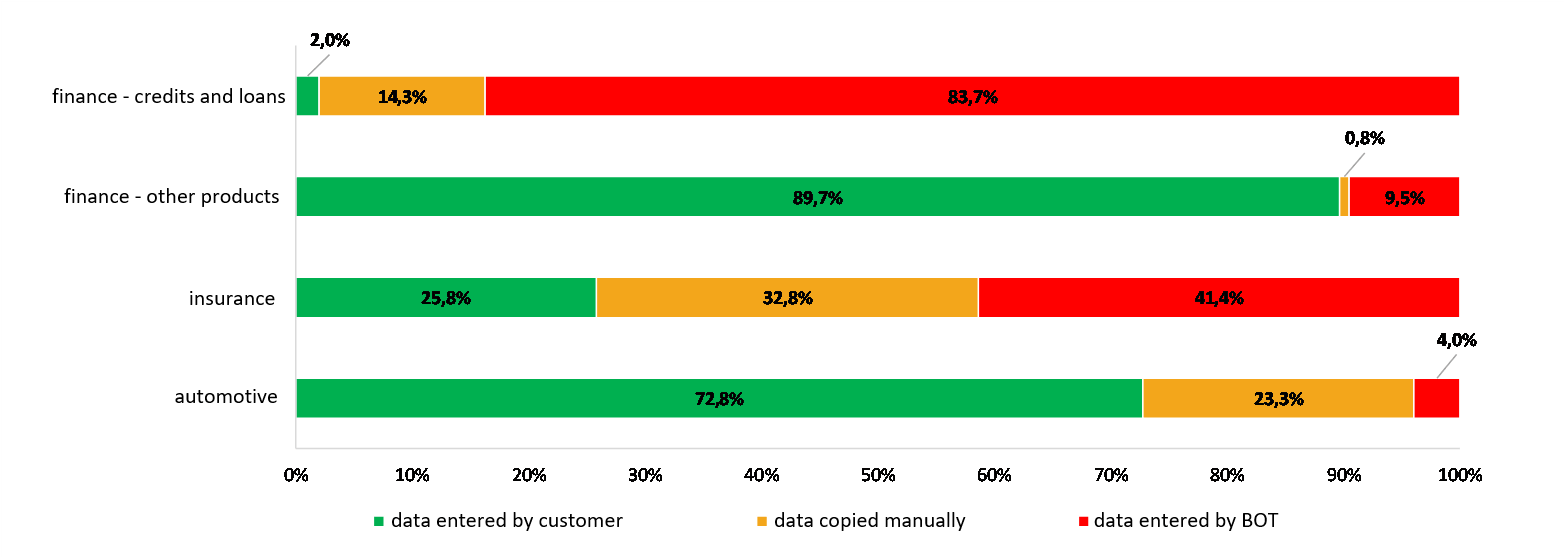

Figure 1: How the contact form is completed in CPL campaigns.

Source: Trafficwatchdog data from December 2019. - November 2020.

The chart above shows the results of Trafficwatchdog’s analysis of the system securing advertisers’ contact forms (a sample of over 10 million leads from December 2019 to November 2020). The data confirms the situation described above. This is particularly evident in the credit and loan category, which is still the most exposed to this type of irregularities - in the period studied, almost 84% of contact forms were completed by BOTs (probability of multiplication or „injection” of data), another 14.3% were pasted using the copy-paste method, and in only 2% we can talk about an average Joe who entered his data on his own.

The second product with a very high share of incorrect leads is insurance. Although the share of data entered by BOTs is much lower than in the case of loans (41.4% vs. 83.7%), the share of manually copied data is very high - as much as 32.8%. This means manual multiplication of customer data, a potentially less sophisticated form of marketing fraud that does not take place in an automated manner. The total of data entered by Bots and copied manually gives us a very high percentage of suspicious forms - almost 3 out of 4 leads fall into these two fraudulent categories.

The opposite is true for other financial services (payment and deposit products), where the vast majority of contact forms (89.7%) are completed by potential customers. The reason for this may be the complexity of contact forms. In the case of these types of products, we are often dealing not with a simple form, but with an application requiring a wider range of data - and these are not so readily available to companies „injecting” or multiplying leads.

Against the backdrop of loan and insurance products, the automotive sector performs quite well - 72.8% of forms were completed by users, and only 4% of forms were the work of BOTs. An area for potential optimisation is manually copied data, i.e. the aforementioned multiplication. Their share in this product category was as high as 23.3%.

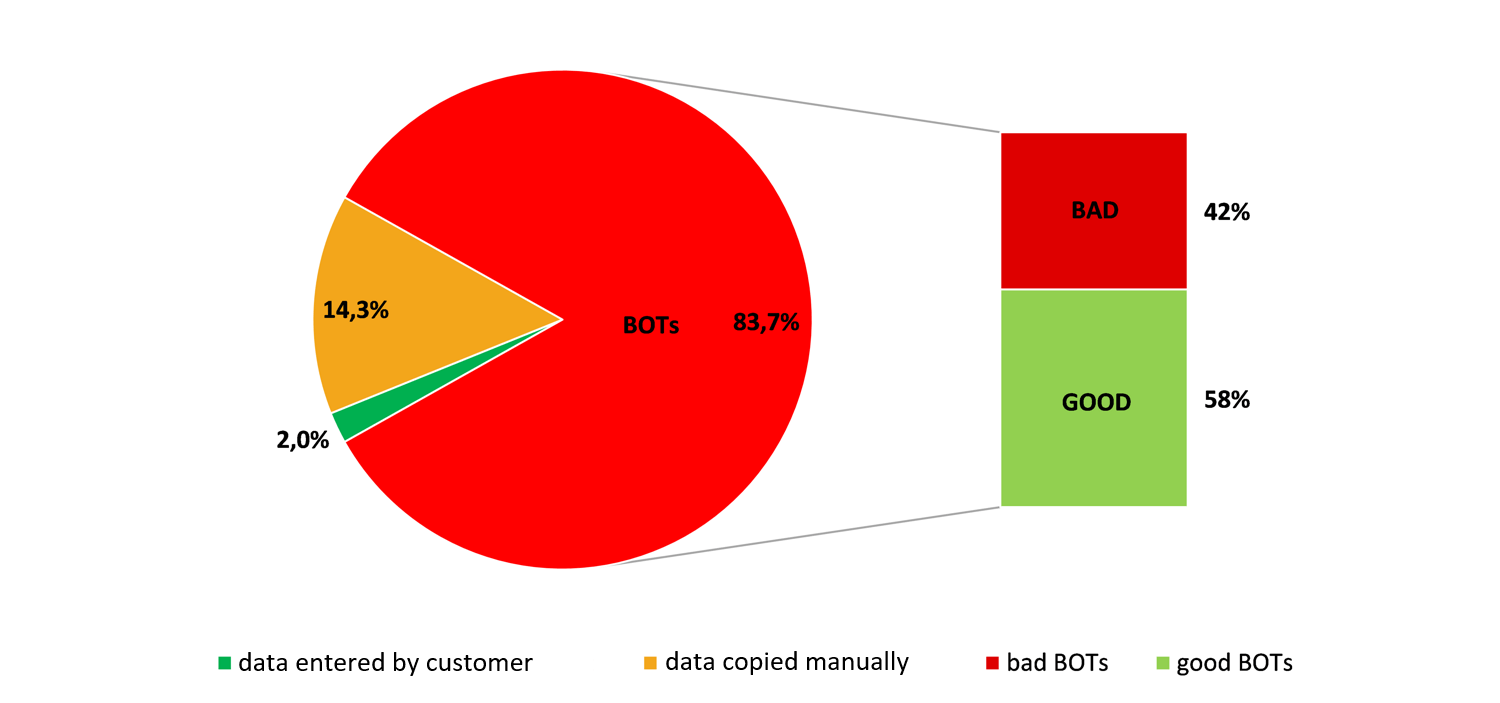

But let’s go back to credits and loans for a moment - there the picture of CPL campaigns looks very unfavourable due to over 80% share of BOTs. However, if we take a closer look at the leads in combination with sales data, it turns out that we can distinguish so-called bad BOTs and good BOTs. So what are ‘good’ BOTs? Many publishers work on their own call centre systems, where customer data obtained during a telephone conversation are redirected to a particular campaign automatically, without being entered manually by a call centre employee. These are therefore valuable leads which are then converted into sales.

Figure 2: Breakdown of good and bad BOTs in CPL campaigns (credits and loans).

Source: Trafficwatchdog data from December 2019. - November 2020.

The chart above shows the estimated share of bad BOTs and good BOTs in CPL campaigns for credit and loan products. The data shows that with this type of campaign we can optimise incoming traffic (contact forms) by over 40% - this is the share of bad BOTs, i.e. in this case data from previously obtained databases „injected” without the customers’ knowledge. For many advertisers this may mean considerable savings, both in terms of marketing expenditure and operating costs (fewer leads means lower demand for call centre resources). An additional „side effect” may be an improvement in the quality of service and speed of contact with customers - which, as we know, is critical in CPL campaigns.

As we can see, acquiring leads online can carry many risks, which is probably why we are currently seeing less interest in this form of campaigning. But should advertisers abandon CPL campaigns?In our opinion, acquiring contacts on the Internet may still be attractive (and profitable!), however, one should properly secure one’s campaign.